Investment Diversification Explained

Investment diversification is an important part of any financial portfolio. While stocks, bonds, and other financial investments are important, there is another asset class that is often overlooked: real estate. Real estate has a number of advantages over other investments and can help expand the diversity of your portfolio. Keyspire offers real estate investing courses that help people get their foot in the door in the real estate investing industry. Learn more about investment diversification below.

What is Investment Diversification?

Investment diversification is the process of spreading out your investments across different asset classes to mitigate risk. The idea is to create a portfolio of investments that will perform differently in different economic conditions. By diversifying your investments, you can protect yourself from losses in one area of the market while still benefiting from gains in another.

Diversify Across Sectors and Industries

When you diversify your investment by holding multiple sectors and industries, you are reducing your risk because of market conditions that may only affect one sector. For instance, if the price of gas goes up, that has a greater effect on the transportation industry, so holding brick and mortar investments helps to reduce risk.

Diversify Within Real Estate

Owning properties and being a landlord is only one of the ways to invest in real estate. You can also take a look at other options within real estate like private lending, equity or development partnerships. By diversifying within real estate, investors can reduce the risk of their investments and spread out their exposure to different markets, helping to protect their investments if one area of the market performs poorly.

Diversity Across Asset Classes

Diversifying your investments across different asset classes like real estate is one of the best types of diversification. Ideally, you have a great mix of different types of investments, and those investments match your unique investor profile and your goals. Examples include stocks, bonds, money market accounts, real estate, and even gold, commodities, or cryptocurrency.

OUR REAL ESTATE INVESTMENT COURSE WILL TEACH YOU ABOUT DIVERSIFICATION AND MORE

Real estate investing is an important piece of a well-diversified portfolio. Keyspire offers real estate investment courses to help teach you about investing as a whole with a focus on real estate investing. To get started, sign up for our free Masterclass today.

Sign Up TodayRecent Blogs

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

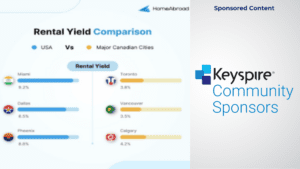

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…

The Invisible Prison: Why Your Success Ceiling Exists Only In Your Mind

Most people blame external factors for their lack of success – the market, the economy, lack of capital, or too…

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my mind…