Determine Your Affordability

For institutional financing to be an option, you need to know what you can afford. There are several tools online that will help you. You should also work with your mortgage broker to determine your affordability.

What Can You Afford?

By entering your annual income, monthly debts, your down payment, and interest rate, you can find an estimate of the mortgage you can afford. There are a number of online calculators that can help you determine your affordability. You can use whichever one you prefer, but here a few suggestions to get you started.

CMHC Affordability Calculator

The Canada Mortgage and Housing Corporation (CMHC) has a great online Affordability Calculator.

Bankrate’s Affordability Calculator

We found this great article from bankrate.com that includes an affordability calculator while also breaking down and defining each component required to determine your affordability. It also includes a section for top mortgage rates in the United States.

What Factors Affect Your Affordability?

Ask any of the communities you participate in and pick the top response. For many of us, Keyspire Inner Circle, or Income Property Labs are your communities, but you can ask any you participate in.

You will want to answer the following 3 questions:

Go ahead – we will keep an eye out for your questions in the groups 🙂

Recent Blogs

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

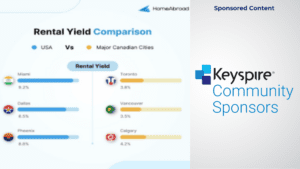

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…