The Six Most Important Statistics You Need to Know When Selecting a Market

Selecting a market to invest in can be stressful, but it doesn’t have to be if you are armed with the right tools and knowledge.

There are many statistics you can go over regarding the real estate market, but we have narrowed down the 6 most important stats that will impact your investing strategy.

In this blog we are going to break down these 6 important stats and show you how to use this data to your advantage in your real estate investing business.

We get these comments all the time: “I don’t know where to start looking,” “My market is not affordable,” “Which stats actually matter?”

Selecting a market to invest in can be stressful if you don’t know what tools to use.

To begin, you need to identify a few things: your goals, your skills, your pre-qualification for financing, your time, and your ideal property type.

Your decision on the market itself should be based on data and NOT emotion.

There are many statistics out there you can look at, but we have keyed in on the 6 most important stats that will impact your investing strategy and they are:

- Purchase Price Range

- Days on Market

- Passive Appreciation

- Vacancy Rate

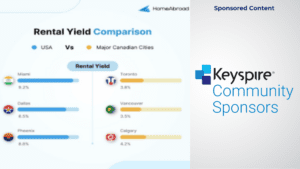

- Rental Rates

- Unemployment

Keyspire Coach Jason and I covered these in a LIVE Training for Income Property Labs. Watch the video below to learn why you need to know these 6 statistics and how to use this data in your income property investing.

Now get out there and start hunting for stats!

There are many websites and organizations you can use to find these statistics, but here are two of our favorites:

(Canada) Canadian Real Estate Association (CREA)

“Organized real estate in Canada operates at three different levels. The real estate board generally operates at a local level. Provincial and territorial associations represent their province or territory and CREA represents the industry nationally and internationally.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single-industry trade Associations, with a membership that includes thousands of Realtors and hundreds of brokerages across Canada.

Keeping informed about all matters real estate with a watchful eye on the economy and government, plus the economic statistics and analysis we provide, enhance our members’ knowledge.”

(US) National Association of Realtors

“The National Association of REALTORS® is America’s largest trade association, representing 1.4 million members, including NAR’s institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries.”

Check out the transcript for this video below:

Let’s talk about the most important statistics that we’re gonna be looking for as an investor. And then talk about how these individual stats will impact your investing strategy. So let’s start with purchase price range here. Okay. So I think this one is definitely a given, okay. You need to understand what is the range for average houses selling in this particular market.

And then the next one is, so that’s obviously gonna be driven from your affordability, how much house can you actually buy? Right. So that’s how it’s gonna impact your investing strategy. Okay. So days on market. So understanding how this is actually going to impact your investing strategy, I would say it’s gonna affect you while you’re looking to offer on a property. So on the entry point of the investment. So if you’re looking at a property that you know, they’re going, that they’re selling really quickly and days on market are one, two, you know, less than 10 days in market, this is going to impact your strategy. From a negotiation standpoint, you’re probably gonna have to go in clean, you need to expect competition, possibly a multiple offer situation. Okay.

For sure.

And then let’s look at the opposite side of that. If days on market are showing of say, you know, 90, maybe even 120 days on the market. As an investor, I’m gonna evaluate that and say, Hey, now I’m actually gonna go in with a low ball strategy and see if I can actually make money on the buy for this particular investment.

Right.

So days on market is a really good, uh, statistic to be watching for.

All right. Next one, passive appreciation. So a very important statistic that again, any investor needs to become incredibly familiar with their local market. So passive appreciation is just how much this market is actually growing from you holding the property.

And it, I encourage everybody who’s watching and who’s running numbers on their property. That when you’re evaluating a property before you purchase, perhaps you should run a couple different scenarios.

Sure.

Run your numbers at, you know, if it’s 3% appreciation versus the high end of the statistic for your particular market, maybe 8% if that’s what, you know, historical figures have shown what you’re gonna notice, is there is a dramatic impact. Your overall, a total ROI, just from this statistic alone, that you make a lot of money off your passive appreciation. Now, a word of caution as investors we wanna be just that and not speculators.

Okay. So when you’re running your math, Run it both ways and say, is this still a sustainable investment with the lower side of the appreciation.

Conservative, nobody’s got the crystal ball. Nobody knows what that’s gonna be, at the end of one, two, even five years. So you want to run it conservatively and then you can sure you can check what it has been historically over the last year or two and then look what they’re projecting it to be and come up with an average and see what the ROI might look like a few years down the road.

Mm-hmm.

But like I said, if you want to run the numbers conservatively, not skew your ROI, then use a number like three or 4%.

Okay. Let’s move on to vacancy rates. So again, a super important statistic that every investor needs to understand for their market.

This is going to directly impact your, cash flow each month. Okay. So if you’re entering into a market, going back to those larger markets, the bigger markets…

Yep.

That you should expect, and I’m sure what you’ll find through your own research is that the vacancy rates are going to be a lot lower. If you’re running your numbers at a zero or 1% vacancy rate, just understand what it actually is in that particular area. Now I’d never suggest an actual 0% vacancy.

No.

Tenants are always gonna turn over regardless. So have something in there is what I would want to see. And if you’re in a market that is, you know, heavily focused on say an energy sector or maybe, uh, a particular, um, employer really takes like, um, a good portion of this particular market, perhaps you wanna run your vacancy rate at 25%, if that’s what’s expected in that particular market,

just to see

so specific

just to see what it looks like, just so you have an understanding cuz

yeah.

As long as you account for it, it doesn’t matter if it’s 5% or 35%.

Yeah.

If the number still work, you’ve accounted for that.

You got it

That number.

Awesome. And then rental rates. So. These are again, statistics that you can investigate and you can find out what you can expect to rent your rental units for. Okay. So again, uh, a direct impact on your monthly cash flow. It’s a direct impact on your total ROI. and again, you’re searching for these statistics before you even purchase a property.

Right.

Okay. So this isn’t like, oh, I found out after that I was expecting to rent this unit for $1,200 per month. No, turns out it’s only $800 per month. Is your look into it..

Right? This is your time and your research, the time that you’ve invested your due diligence, right?

Yeah, exactly. Um, and then the final one for this slide is unemployment rates as well.

So again, a super important statistic. You need to understand what is happening right down to that micro level. Okay. So unemployment is going to, um, impact who your tenant profile actually is who are the people you’re intending to rent to? And how is the job growth in that particular area?

Recent Blogs

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…

The Invisible Prison: Why Your Success Ceiling Exists Only In Your Mind

Most people blame external factors for their lack of success – the market, the economy, lack of capital, or too…

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my mind…