What You Need When Applying for Financing

Being prepared before meeting with your Mortgage Broker or Lender to complete a financing application can make the process more efficient and less stressful. Use this document as a guide to begin preparing your personal documents for your financing application.

Note: This checklist is a general guide only. Each party applying on the financing application should have their own individual set of documents. Show original documents, the broker or lender will take copies if necessary.

Additional documentation may be required during the financing process depending on your personal situation, the type of financing product you chose, and/or the property type.

Mortgage Broker/Lender Application Document Checklist

General Application Documents

Two (2) Personal Identification Documents

- Examples: Driver’s License, Passport, Proof of Citizenship, Permanent Resident Card, Social Insurance Number

Two (2) Employment and income verification documents (more if applicable)

- If employed: Latest pay statements, most recent T4/W-2, employment letter on company letterhead

- If self-employed: Business license/sole proprietorship/articles of incorporation, business financials

- Government-issued income forms and/or Notice of Assessment (NOA) for past 2 years

- Other income: Legal agreements to demonstrate receipt of spousal or child support payment

- Other compensation: Disability, pension, rental income, etc.

Property Ownership Information (for each property currently owned)

- Recent mortgage statement

- Transfer/Deed of Land

- Charge/Mortgage

- Most recent property tax bill/statement

- Documents verifying heating costs and condo fees

- Insurance policy

Banking Information Including: Financial Institution, Transit Number, Account Number

General Application Documents

Agreement of Purchase and Sale

MLS listing or feature sheet of property

Confirmation of down payment (statements of monies in bank, gift letter, proof of sale, etc.)

Name, address, telephone number, and email of your lawyer/attorney/notary

Recent Blogs

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

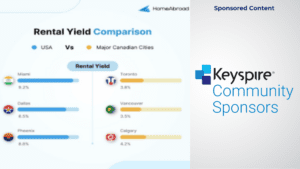

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…

The Invisible Prison: Why Your Success Ceiling Exists Only In Your Mind

Most people blame external factors for their lack of success – the market, the economy, lack of capital, or too…

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my mind…