Preparing to Purchase a Property – What You NEED!

Proper planning for purchasing a property: paperwork.

Say that three times fast!

When purchasing an income property, our first thoughts usually revolve around purchase price, after repair value, and rental rates, but there are a number of other nuances we need to keep in mind when purchasing a property such as:

Click HERE to download the Checklist

Check out a transcript of the video below:

So the first thing we wanna start with typically is we wanna assess our present household budget and also our annual income to determine what our eligibility is. We wanna know what we can comfortably afford and what price range we’re looking in. So starting off with getting a pre-approval from a Mortgage Specialist or Broker is really important.

It’ll give you a more realistic idea of the expectation of what you can afford, but keep in mind, there’s no guarantee. Market changes, interest changes or anything have, and personal changes that may occur, could change that preapproved amount. And they tend to be a little overestimated to start with too.

So just keep that in mind and also, the first thing where we’re gonna start with is what you’re gonna need is…

Your identification, right?

Yeah.

So you need to have ID, it needs to be government issued ID. A lot of folks think that they can just show up, sign paperwork, whatever. You know, your OHIP is not your Ontario health card or your provincial health card is not considered government issued ID when it comes to identifying who you are, you need things like birth certificates, passports, driver’s license, all of those things that identify who you are when you’re doing your transaction.

Now, this has a lot to do with money laundering…

mm-hmm.

Making sure that the federal proceeds of crime are not done and terrorist financing are not done through real estate.

Mm-hmm.

So, you know, that it’s really important that you have your, your ducks in order you have your documentation, don’t even bother looking until you have your documentation, because you’re gonna be stopped at the gate.

Right?

Mm-hmm.

This is the gatekeeper of whether you can get financing or not is having that correct government issued documentation.

And just to add in that they wanna do this in person as well. You can’t just send them the photocopy, you have to come to them or they come to you either way realtors have to verify this. And it’s kept on file for about what five years?

I think so.

Yeah. It’s kept on file. I know that when I go to my lawyers, I always bring my passport with me, even though I know him. I don’t know when it’s gonna expire when it’s, you know, when he’s gonna have to revalidate who I am. So I bring it with me for every transaction.

So identification. Really super important. You know, Catherine talked about preapproval, no point in going and looking for properties. If you don’t know what’s in your wallet. Know how much you can realistically afford something to consider when you’re being preapproved as well, is what’s the purpose of this purchase?

Are you gonna do a renovation and Flip to Yourself? Because if you’re preapproved for $400,000, don’t go buy a $400,000 house, buy a $300,000 one that you’re going to refinance up to that $400,000. Right? And I think that’s where people sometimes leave a lot of equity on the table based on whatever it is that they’re going to do, because they haven’t thought into the future.

If I pre-qualified now for $400,000 I, you know, and I wanna refinance. You need to take that into consideration.

So have a plan.

Yeah. Have a plan. Don’t don’t leave money on the table. Have a, have a plan. Good, good, good point.

Okay. So we’re gonna start with your mortgage application, not the details of the process, but some really key points here.

So. I find a lot of people get upset when they’re going, oh my God, the mortgage broker, the lender they’ve asked for this extra document. And then you’re in the 11th hour, it’s getting close to closing and they ask for these things and, you know, we get upset and we get mad at the mortgage broker, the lender, but really it’s because we didn’t anticipate you know what they’re gonna need.

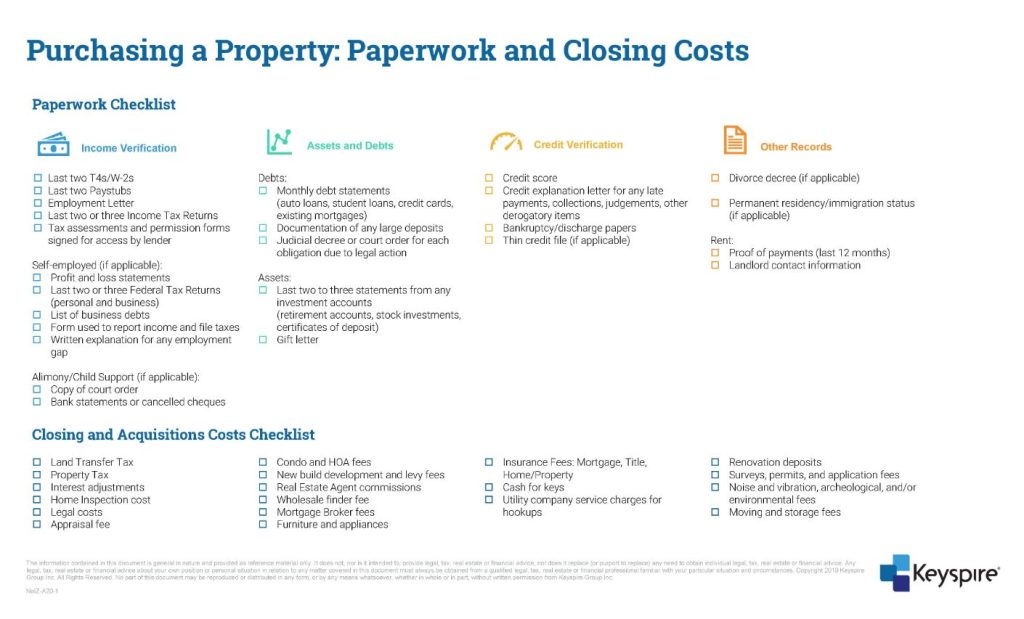

So today this is what we’re gonna try to make sure everyone’s more prepared. So mortgage application information. So it falls under income verification, and assets and debts, credit verification, and other records.

Recent Blogs

The Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my…

Attract Higher Paying Tenants by Being Pet Friendly!

Optimizing an investment property is all about maximizing your income and minimizing your workload and expenses, such as tenant turnover.…

The 7-Step JV Process

“It’s better to own 10% of 100 properties than 100% of 1 property.” No matter how wealthy and successful…

Income Vs Net Worth

In today’s world, two of the most important financial metrics are income and net worth. Understanding the distinction between the…