How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S.

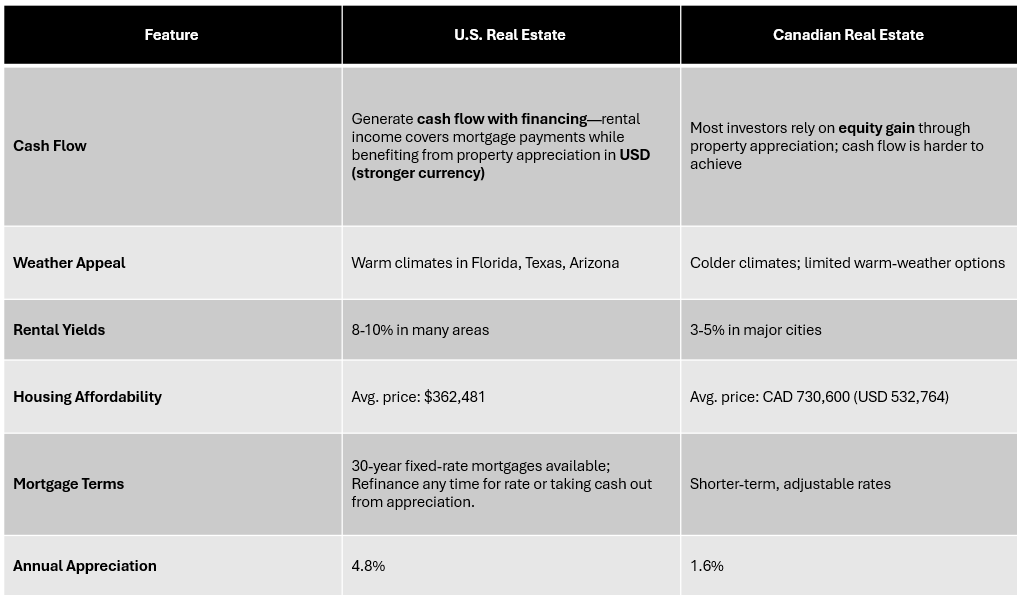

Canadians have invested a staggering $89.3 billion in U.S. real estate over the last decade. With higher rental yields (8-10%), more affordable property prices and ability to generate passive income with financing, the U.S. presents a lucrative opportunity for Canadian investors looking to build long-term wealth.

But what exactly makes the U.S. real estate market so attractive compared to Canada? Let’s explore why thousands of Canadians are expanding their investment portfolios south of the border.

7 Reasons Why Canadians are Investing in U.S. Real Estate

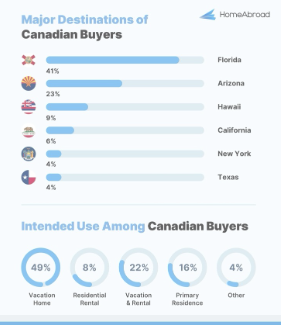

Canada ranked as the top foreign buyer of U.S. real estate in 2024—here’s why Canadian investors are increasingly shifting their focus to the U.S.:

- U.S. Properties Are More Affordable

Real estate in cities like Toronto and Vancouver is notoriously expensive, with average prices exceeding CAD 1 million. Meanwhile, U.S. markets such as Florida, Texas, and Arizona offer affordable entry points for investors, allowing Canadians to buy larger or multiple properties with the same capital.

For example:

- Toronto’s avg. price per square meter: $10,947

- Miami’s avg. price per square meter: $3,170

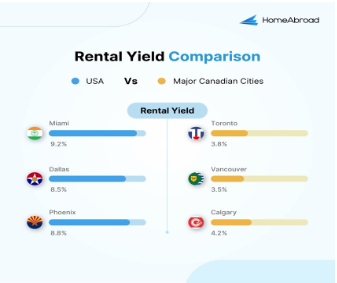

- Higher Rental Yields Mean More Passive Income

The U.S. market offers significantly higher rental yields—often between 8-10%—compared to Canada’s average of just 3-5%. Combine that with fixed rate mortgages amortized over 30 years – means rent covers mortgage and more cash flow to your pocket.

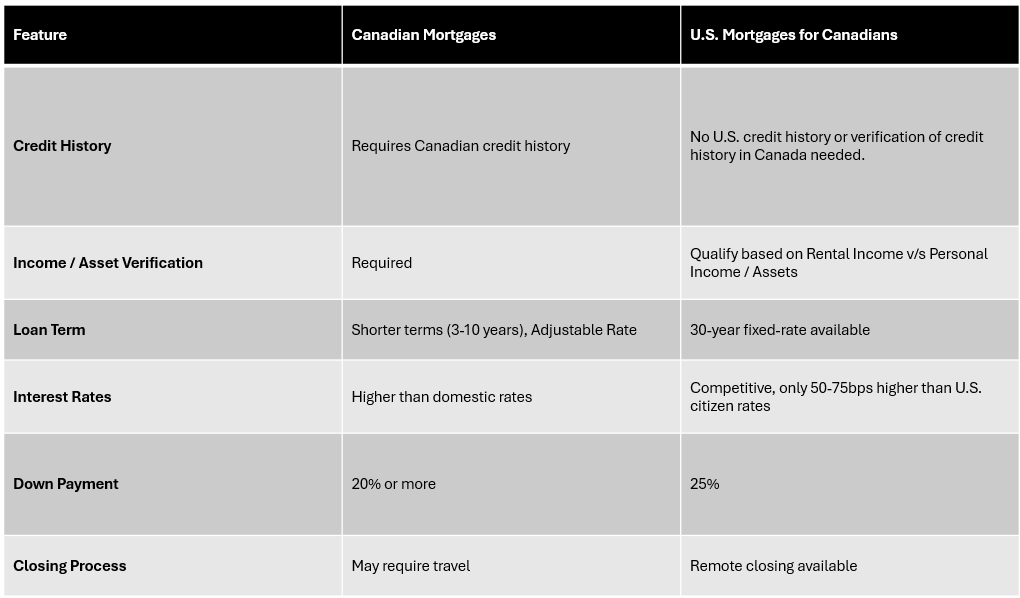

- Easier Access to U.S. Mortgages for Canadians

Many Canadian investors are unaware that they can qualify for U.S. mortgages without a U.S. credit history or residency. HomeAbroad makes financing simple with tailored loan programs for Canadians.

- 30-Year Fixed Mortgages Provide Stability

One of the biggest advantages of U.S. real estate investment is access to 30-year fixed-rate mortgages. In contrast, Canada primarily offers shorter adjustable-rate mortgages, making long-term planning more challenging. With fixed rates, your monthly payment remains fixed for the loan term, while the cash flow will increase year-over-year as the rent increases.

Get Your Free Mortgage Rate Quote

- Property-Based Financing: No Personal Income Required

HomeAbroad’s DSCR (Debt Service Coverage Ratio) loan allows Canadians to qualify for a mortgage based on rental income alone. This means no personal income verification is needed, making it easier to scale your portfolio.

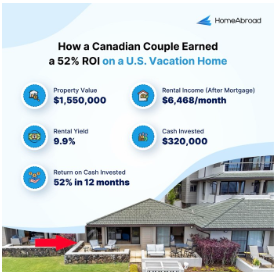

Case Study: Liam and Emma, a Canadian couple, purchased a $1,550,000 vacation home in Hawaii with HomeAbroad’s DSCR loan. The property generates $6,468 in monthly rental income, delivering a 9.9% rental yield and a 52% return on cash invested.

- No Extra Taxes for Foreign Buyers

Unlike Canada, where some provinces impose additional taxes on foreign property buyers, the U.S. treats Canadian investors the same as local buyers. Additionally, the U.S.-Canada tax treaty prevents double taxation, maximizing your returns.

- U.S. Property Values Appreciate Faster

In the past year, U.S. property values grew by an average of 4.8%, compared to just 1.6% in Canada. This means Canadian investors in the U.S. see faster capital appreciation, adding to long-term wealth growth.

How to Get Started with U.S. Real Estate Investment

Many Canadian investors hesitate to invest in the U.S. due to concerns about mortgages, taxation, and property management. That’s where HomeAbroad simplifies the process.

Why Choose HomeAbroad?

✅ One-Stop Solution: From property search to mortgage financing, HomeAbroad handles everything.

✅ Exclusive Canadian Mortgage Programs: No U.S. credit history required. Lock in a highly competitive rate tailored for Canadian investors

✅ AI-Powered Investment Search: Discover top investment properties with curated listings, cash flow and profitability analysis and real-time market alerts.

✅ 500+ Real Estate Experts: Get personalized guidance from local agents.

✅ Concierge Services: LLC setup, bank accounts, insurance, and property management.

Discover Your Right Investment Property Now

Take the Next Step Today!

If you’re ready to start investing in U.S. real estate, HomeAbroad makes it easy. Our seamless platform help you secure a U.S. mortgage with no SSN, visa, or credit history. Discover properties with our AI-powered search, connect with expert agents, form a U.S. LLC, and open a U.S. bank account—all on one global-friendly platform.

🔹 Get pre-approved for a U.S. mortgage today! 🔹 Find high-yield investment properties with ease! 🔹 Maximize returns with expert guidance!

Don’t wait—capitalize on the U.S. real estate market today!

_______________________________________________

The information contained in this blog is general in nature and provided as reference material only. It is not intended to provide legal, tax or financial advice, nor does it replace (or purport to replace) any need to obtain individual legal, tax or financial advice. Any legal, tax or financial advice about your own position or personal situation in relation to anything covered in this presentation should always be obtained from a qualified legal, tax, or financial professional. This blog is Copyright Keyspire Group Inc. All Rights Reserved. No part of this work may be reproduced or distributed in any from, or by any means whatsoever, without written permission from Keyspire Group Inc.

Recent Blogs

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

The Invisible Prison: Why Your Success Ceiling Exists Only In Your Mind

Most people blame external factors for their lack of success – the market, the economy, lack of capital, or too…