Did You Sign a Fixed Mortgage in 2022, 2023 or 2024?

If you secured a 3-year fixed mortgage in 2022, 2023, or early 2024, there’s a high likelihood that you’re overpaying. You may be missing an opportunity to enhance your monthly cash flow and reduce interest expenses, and future-proof your portfolio against rising risks in the lending market.

This isn’t just about lowering your rate – it’s about lowering your monthly payments, increasing cash flow, and taking back thousands of dollars that the banks will collect from us if we don’t act soon.

Why This Matters Right Now

Let’s rewind to mid-2022. Inflation was surging, and in response, central banks rapidly increased overnight rates, which pushed borrowing costs to levels not seen in over two decades.

Investors, especially those purchasing or refinancing, were left with limited options:

- 5-year fixed rates spiked into the 6.49 – 6.99% range

- Variable rates increased to 6.50% – 7.20%

- 1 and 2-year terms were even more expensive, or too risky

The 3-year fixed became what felt like the only move – offering better rates, which translated to lower mortgage payments and an easier stress test approval.

Fast-forward to today:

- 5-year fixed rates are back in the 3.99% – 4.49% range

- Inflation has seemingly stabilized for now

- Fixed mortgage pricing is currently moving in favour of the borrower

If you’re holding a 3-year fixed from 2022 or 2023, there’s a high probability that your current mortgage is now your most inefficient line item – dragging down cash flow, limiting equity growth, and exposing your portfolio.

The Investor’s Case for Breaking Your Mortgage Early

We know what you’re thinking… “But I still have time left. I’ll wait for renewal…”

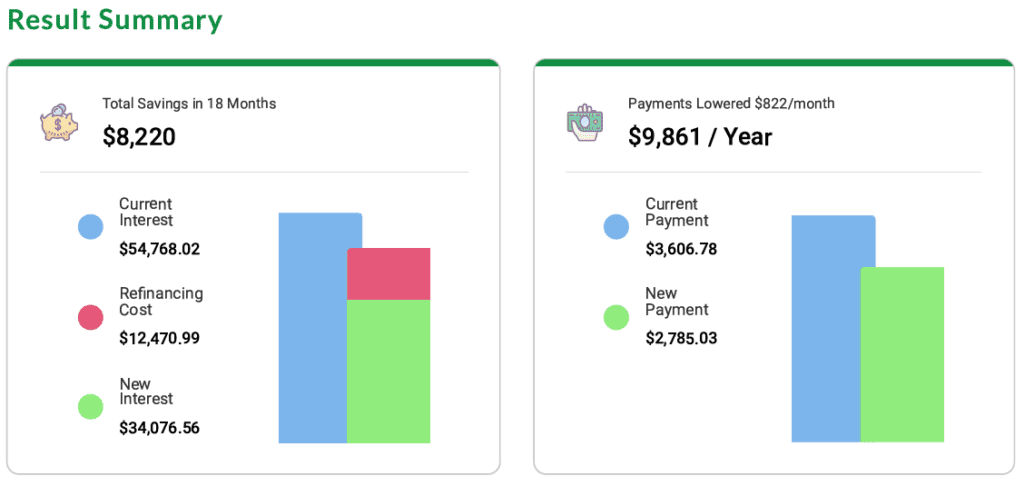

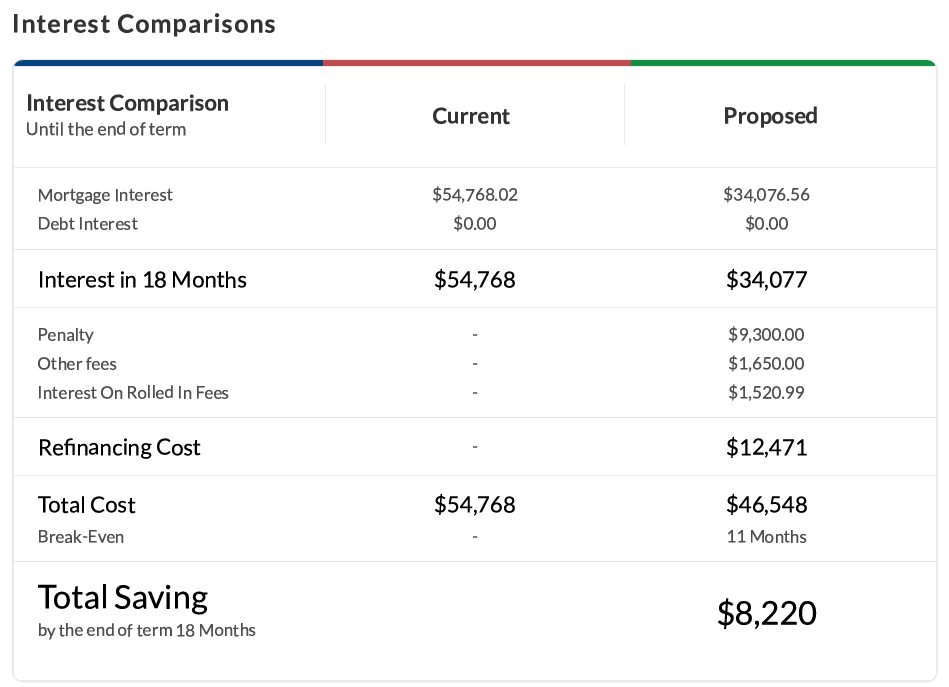

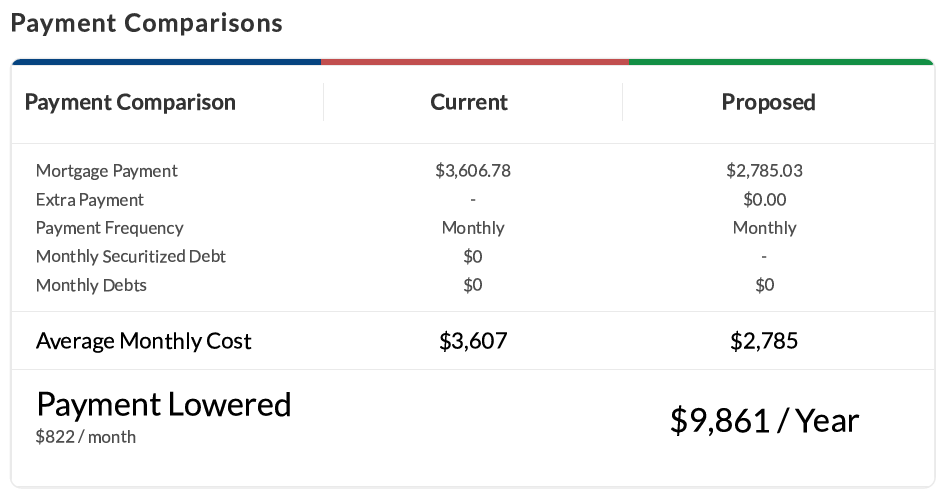

This could be incorrect. Over the past 2 months, we have saved our clients over a combined $340,000 in interest and mortgage payments, by helping them escape their high-interest fixed rate mortgages in exchange for lower mortgage rates, to increase cash flow, and to lower interest payments.

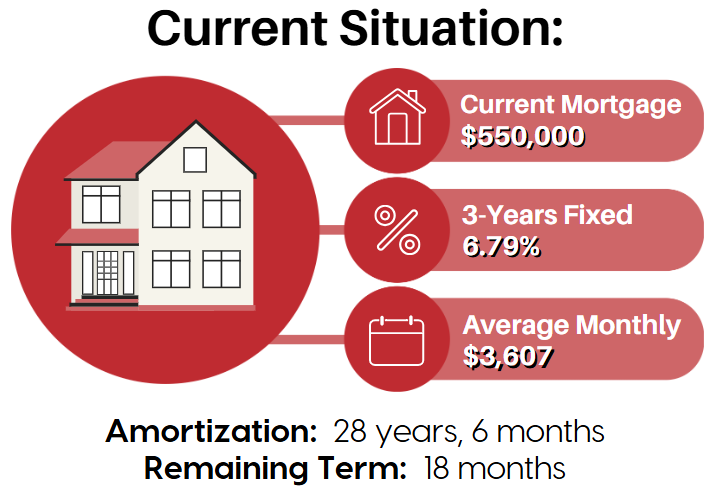

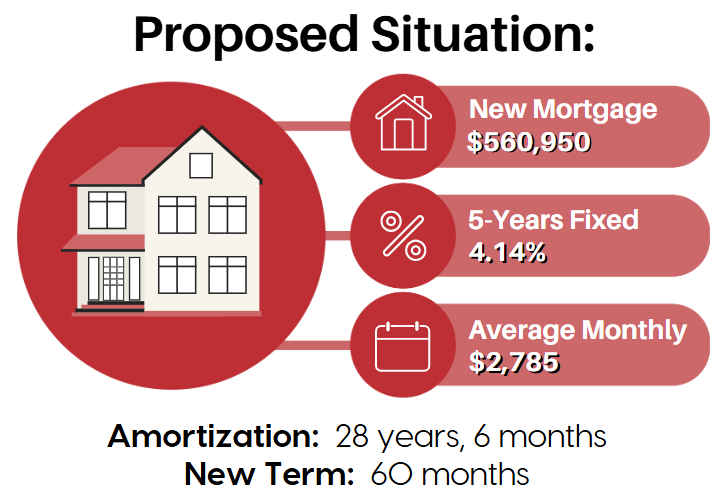

Here is just one scenario of how we were able to help our clients:

Portfolio-Level Benefits

This isn’t just about one mortgage. Breaking a high-rate term early, can improve your portfolio’s overall financial structure:

- Boost net operating income (NOI)

- Strengthen debt service coverage ratios (DSCR)

- Improve qualification for future purchases

- Lower total cost of capital

- Increase pre-tax cash flow

- Realign amortization for equity growth

With more investors facing stress-test limits, DSCR challenges, and lender risk reclassification, every dollar counts.

“But What About the Penalty?”

Great question! And it’s a common one.

As you can see, we have calculated every last dollar when making sure that breaking your mortgage makes sense. Does this take a lot of time? NO!

In just 10 minutes, our team can analyze your properties in higher fixed rate mortgages and create for you a curated report that shows your potential savings, without having to provide us with a single document!

Now May Be the Best Chance to Get a Lower Interest Rate – Best in 3 Years

We haven’t seen this level of opportunity in the mortgage market since before COVID. And with geopolitical volatility, trade tensions, and economic uncertainty still looming, we’re currently in one of the most favorable windows to re-evaluate your mortgage than we’re likely to see for years to come.

There’s no telling what the Bank of Canada will do in the next 12 – 18 months. If inflation is not “transitory” (as from what we are hearing from our finance minister and the tariff war persists), inflation could continue to uptick. Even though we currently have a weak job market and stagnant GDP, the Bank of Canada would be forced to re-evaluate the continuation of lowering rates and could look at pausing or potentially increasing the overnight rate. Doing so could very well lead the bank and mortgage lenders to re-apply “risk premiums” to their rate offerings. In turn, this could further increase the spread of the of the banks’ rate offerings in relation to the bond yields, which will start to increase fixed rates again.

Locking in now gives you:

- Peace of mind through to the year 2030

- Budget stability

- Improved property performance

- The ability to leverage better DSCR for lender qualifying if you plan to continue purchasing

Heading into the spring market there is no better time to re-assess your portfolio and take the right steps to ensure you are in the best financial position. There’s no cost to finding out if you can save – reach out to us now at: [email protected] or check out our online resources:

Recent Blogs

Maximizing Cash Flow with PACD Homes: A Smarter Approach to Real Estate Investing

The Ontario housing market is at a crossroads. With rising demand and a shortage of available homes, investors and homeowners…

Investment Property Insurance – BrokerLink

Landlords come in all shapes and sizes, and sometimes, landlords of certain types of buildings have different insurance needs. While…

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…