All Blogs

Maximizing Cash Flow with PACD Homes: A Smarter Approach to Real Estate Investing

The Ontario housing market is at a crossroads. With rising demand and a shortage of available homes, investors and homeowners are searching for innovative solutions to maximize returns while addressing the housing crisis. Enter Accessory Dwelling Units (ADUs)—a game-changing investment that aligns perfectly with Keyspire’s 4 Ways to Win (4WTW)…

View MoreDid You Sign a Fixed Mortgage in 2022, 2023 or 2024?

If you secured a 3-year fixed mortgage in 2022, 2023, or early 2024, there’s a high likelihood that you’re overpaying. You may be missing an opportunity to enhance your monthly cash flow and reduce interest expenses, and future-proof your portfolio against rising risks in the lending market. This…

View MoreInvestment Property Insurance – BrokerLink

Landlords come in all shapes and sizes, and sometimes, landlords of certain types of buildings have different insurance needs. While standard landlord or rental property insurance is the most common type in Canada, there are others that may be worth considering depending on your circumstances. BrokerLink Insurance offers…

View MoreWhy Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the barriers to entry—large capital requirements, complex transactions, and hands-on management—can be overwhelming. That’s where addy comes in, breaking down those barriers and making real estate investing accessible to everyone. Whether…

View MoreCreating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book for younger generations, TSFH has evolved into a complete business—serving homebuilders, buyers, municipalities, & investors. With the completion of the pilot project, TSFH has expanded across Canada, in a…

View MoreLeveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate investing, the key to success lies in leveraging different financial tools to maximize returns and secure long-term growth. One powerful strategy that is gaining traction among real estate investors is…

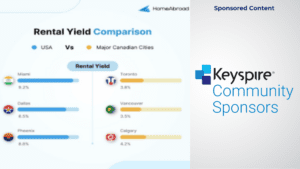

View MoreHow Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over the last decade. With higher rental yields (8-10%), more affordable property prices and ability to generate passive income with financing, the U.S. presents a lucrative opportunity for Canadian investors looking…

View MoreThe Invisible Prison: Why Your Success Ceiling Exists Only In Your Mind

Most people blame external factors for their lack of success – the market, the economy, lack of capital, or too much competition. But after generating $15M in real estate deals in just 10 months, I discovered something surprising: success is 95% mindset, 5% everything else. Here’s what nobody tells…

View MoreThe Best Time To “Cash Out” Is…

“When should I ‘cash out’ and sell my properties?” I hear this question a lot and it blows my mind how many investors are stuck in this profit-losing mindset. In the video below I tell a story about the first time someone asked me that and how I explained to…

View MoreAttract Higher Paying Tenants by Being Pet Friendly!

Optimizing an investment property is all about maximizing your income and minimizing your workload and expenses, such as tenant turnover. This blog focuses on a specific way you can optimize that many investors are reluctant to do. I don’t want to spoil it before you watch the video,…

View More