4 Small Real Estate Investment Steps to Results

Real estate investing can be an intimidating path or goal. With so many unknowns it can be difficult to know where to start. Keyspire was founded by Scott McGillivray and Michael Sarracini in order to help budding real estate investors become educated, savvy and successful. Here are four small steps to get started on your real estate investment journey.

Research Your Local Real Estate Market

Before investing in any residential or commercial property, it is important to understand and become and expert in that local real estate market. Research the area and look at current trends to determine if there is a potential for profit. Pay attention to the local economy, population growth, transportation, employment rate, and any other factors that could impact the value of the property.

Create a Plan

Set goals for yourself and create a plan for achieving them. Decide on the types of properties you want to invest in and create a budget for the acquisition, maintenance, and exit strategy.

Network with Other Investors

Connect with other real estate investors and build your community. Not only will they provide valuable insight and advice, but they can also help you find deals and alert you to potential opportunities. Keyspire has an incredible community of like-minded investors just like you.

Take Action

Once you have done your research and created a real estate investing plan, you need to take action. Start looking for real estate investment properties that meet your criteria and make offers. Don’t be afraid to negotiate and make sure to do your due diligence before signing any contracts.

Recent Blogs

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

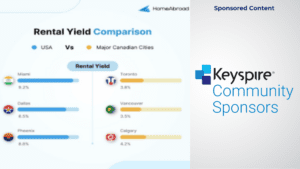

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…