Beverley & Marty

REI Portfolio Value: $2,090,900

Rental Units/Doors: 7

“We have increased our net worth by 1 million in almost exactly 5 years. Our younger daughter has long since graduated and bought her own rental.”

Strategies Used:

- Joint Venture

- Pre-Construction Property

- Flip to Yourself

- Buy & Build

- Multi-Unit Residential

- REIT

- Buy & Hold

- Conventional Financing

- Turnkey Properties

- Buy, Reno, Rent & Refinance

- Land Development

Beverly & Marty talk about where they were prior to joining Keyspire and what they have achieved since

“When we first came to Keyspire, we already had one rental house. We were working full time, trying to pay down debt and save for future university tuition for our young daughter. (My eldest was already established – Marty). We were seriously discouraged with our rental and were considering selling it. We had not selected tenants well and had a mess on our hands. My wife heard about the masterclass and on a whim, registered us. I remember telling my wife, “We’re not buying anything! “Two hours later we signed up for the workshop! We went on to the summit later that year.

Not only did we keep our rental, we bought 4 more in 5 months including two in a JV. We moved our RRSPs to passive real estate opportunities and eventually bought into 7 different projects both in Ontario and as far as Florida.

So how have we done? Well, we finally did sell that first rental for a 300,000 profit. Our ROI. Infinite, because we already flipped to ourselves and had all our investment back. Realistically we turned a 24 k reno expense into 300 k on one property alone over 9 years (272 profit and 125% per year,). The other four we bought? We turned 217 k in down-payments into 993 k So 775 of that is profit. (71% annual ROI). We have an HYOT that pays us 1300 a month at 10% .The RRSP investments are about to mature ranging between 30 and 40%.

All in all we have increased our net worth by 1 million in almost exactly 5 years. Our younger daughter has long since graduated and bought her own rental. We owe Michael and Scott so much. We recommend Keyspire to anyone who’ll listen and even crashed a few masterclasses back when we could, just to stand up and share our story. We hope to do so again soon. Here’s hoping we can all gather at another summit soon, I know we will be there.”

Beverly and Marty talk about the role Keyspire played in their success and the biggest benefit they got from Keyspire programs:

“Without Keyspire, we would’ve sold that initial rental and maybe made a few dollars. With Keyspire‘s training and the opportunities that we were presented, we are a million dollars wealthier in 5 years. Our family has benefited from what we’ve learned too. We constantly refer to our training even in conversation between us. The biggest benefit has been learning and the respect of people who see just what knowledge can do. People now ask us our opinion on markets and opportunities. Knowledge We have expanded into two other opportunities where our knowledge and experience pay off Financial freedom to take those family vacations and pay for all eight of us. This has allowed us to spend real quality time with our grandkids. We know that we will leave our family in a far better place both financially and educationally.”

Beverly and Marty have taken the whole family on paid vacations, not once but twice. They still work, but because they want to, not because they have to. Beverly and Marty’s retirement looks completely different, and their daughters look forward to taking the reigns someday.

Recent Blogs

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

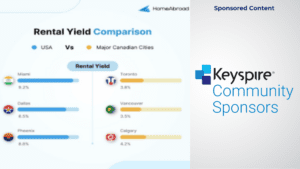

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…