Fern & Ray

REI Portfolio Value: $10,445,000

Rental Units/Doors: 20

“When I first joined Keyspire, my real estate net worth was $73,000. Since then our company has purchased 2 more deals on our own and 17 properties with Joint Ventures. Our share of our current real estate net worth/equity is $1,137,000!!!”

Investing Strategies Used

- Flip to Yourself

- Conventional Financing

- Buy & Hold

- Student Rentals

- Private Lending

- Buy, Reno, Rent, Refinance

- REIT

- Land Development

How Keyspire impacted Fern’s lifestyle and how he increased his net worth:

“In one word – FREEDOM! Leaving my job in Sept 2020, gave me the freedom of my time to control my schedule. In April 2021, I hired an assistant to help with the day-to-day tenant maintenance requests and tenant pre-qualification. Because of this, I was able to take the summer “off” – working 20hrs/week when the kids were with their mother instead of 40-60. When the kids were with me, we were on holidays all summer.

When I first joined Keyspire, my real estate net worth was $73,000. Since then our company has purchased 2 more deals on our own and 17 properties with Joint Ventures. Our share of our current real estate net worth/equity is $1,137,000!!! I just calculated that for the first time!!! I knew it went up but didn’t realize by how much! Between cash flow and property management our income has increased to $8100/month”

Where Fern was prior to joining Keyspire:

“I had just gotten out of a broken marriage. I had the realization that my financial situation, or lack thereof, was behind me, losing the matrimonial home-my dream waterfront home so something needed to change. I joined Keyspire in March 2018 and quit my job in September 2020”

Fern talks about the biggest benefit to joining Keyspire:

“Keyspire opened my eyes to Joint Ventures which I had never heard of before. I had previous experience in real estate investing and was looking to get back into it by starting a property management company. When I learned about Joint Ventures during the Roadshow, I knew instantly this was the model I was looking for. My goals went from buying 1 or 2 properties over the next 10 years to 20. Turns out I reached that new goal in 3 years.”

Fern continues to grow and expand his real estate portfolio into a growing empire, all while enjoying the financial freedom his real estate investments have earned him!

Recent Blogs

Why Now Is the Best Time to Start Real Estate Investing with addy

Investing in real estate has long been one of the most reliable ways to build wealth, but for many, the…

Creating Opportunity While Solving Affordability!

The Self Funding House® (TSFH) has created opportunity for investors with a revolutionary new-construction p roduct, embracing legal rental units. Originally a book…

Leveraging Infinite Banking for Real Estate Investing: How You Can Multiply Your Dollars

Are you a real estate investor looking to learn more about wealth-building strategies? In the world of real estate…

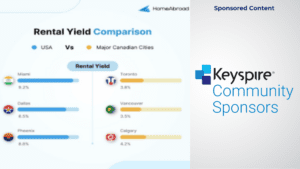

How Canadians Can Build Wealth with US Real Estate Investment

Why More Canadians Are Investing in the U.S. Canadians have invested a staggering $89.3 billion in U.S. real estate over…